API3

API3

API3 is a collaborative project to deliver traditional API services to smart contract platforms in a decentralized and trust-minimized way. It is governed by a decentralized autonomous organization (DAO), namely the API3 DAO.

Read more about how The API3 DAO works. Click here

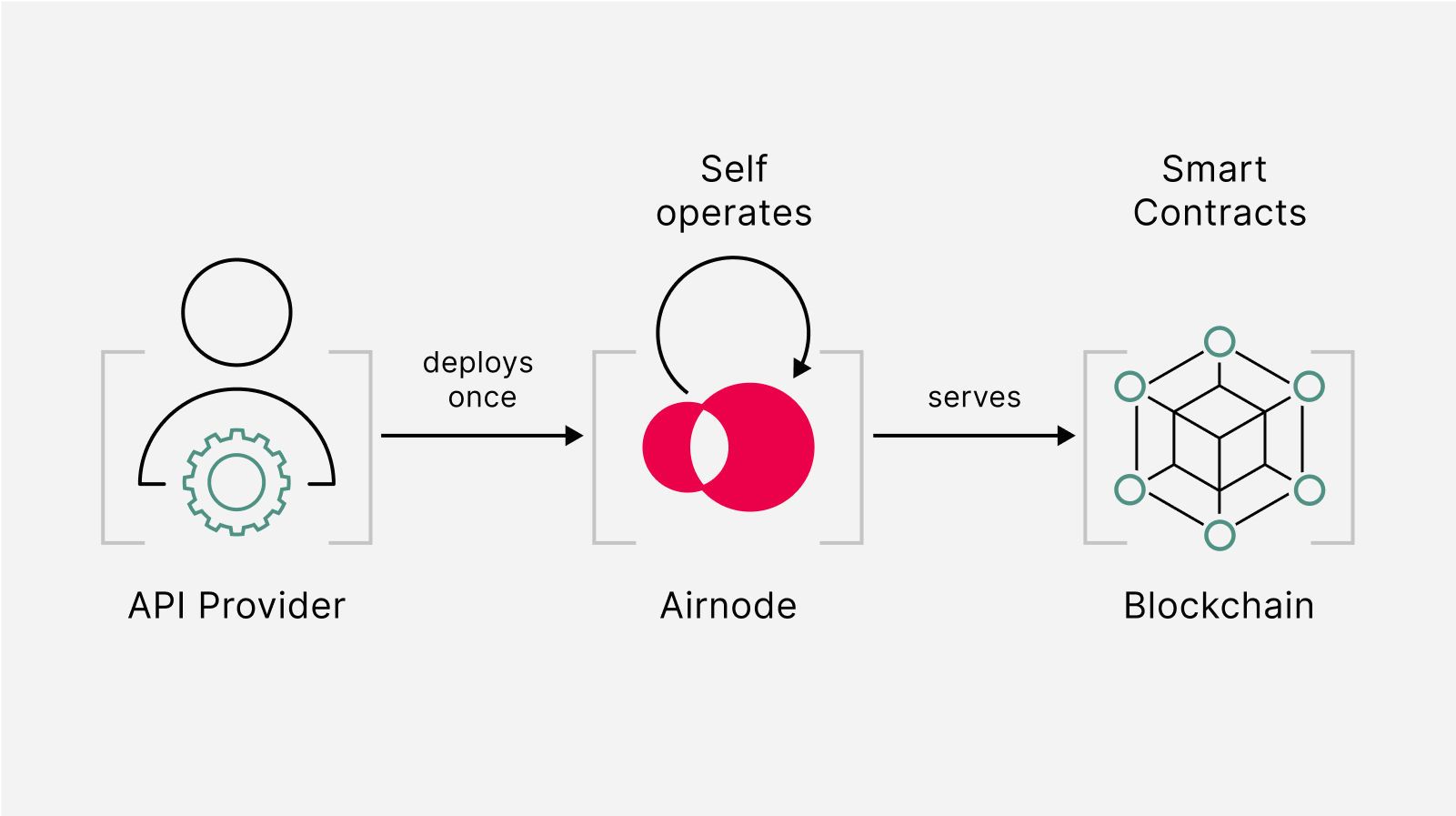

Airnode

Developers can use Airnode to request off-chain data inside their Smart Contracts on Kava. An Airnode is a first-party oracle that pushes off-chain API data to your on-chain contract. Airnode lets API providers easily run their own first-party oracle nodes. That way, they can provide data to any on-chain dApp that's interested in their services, all without an intermediary.

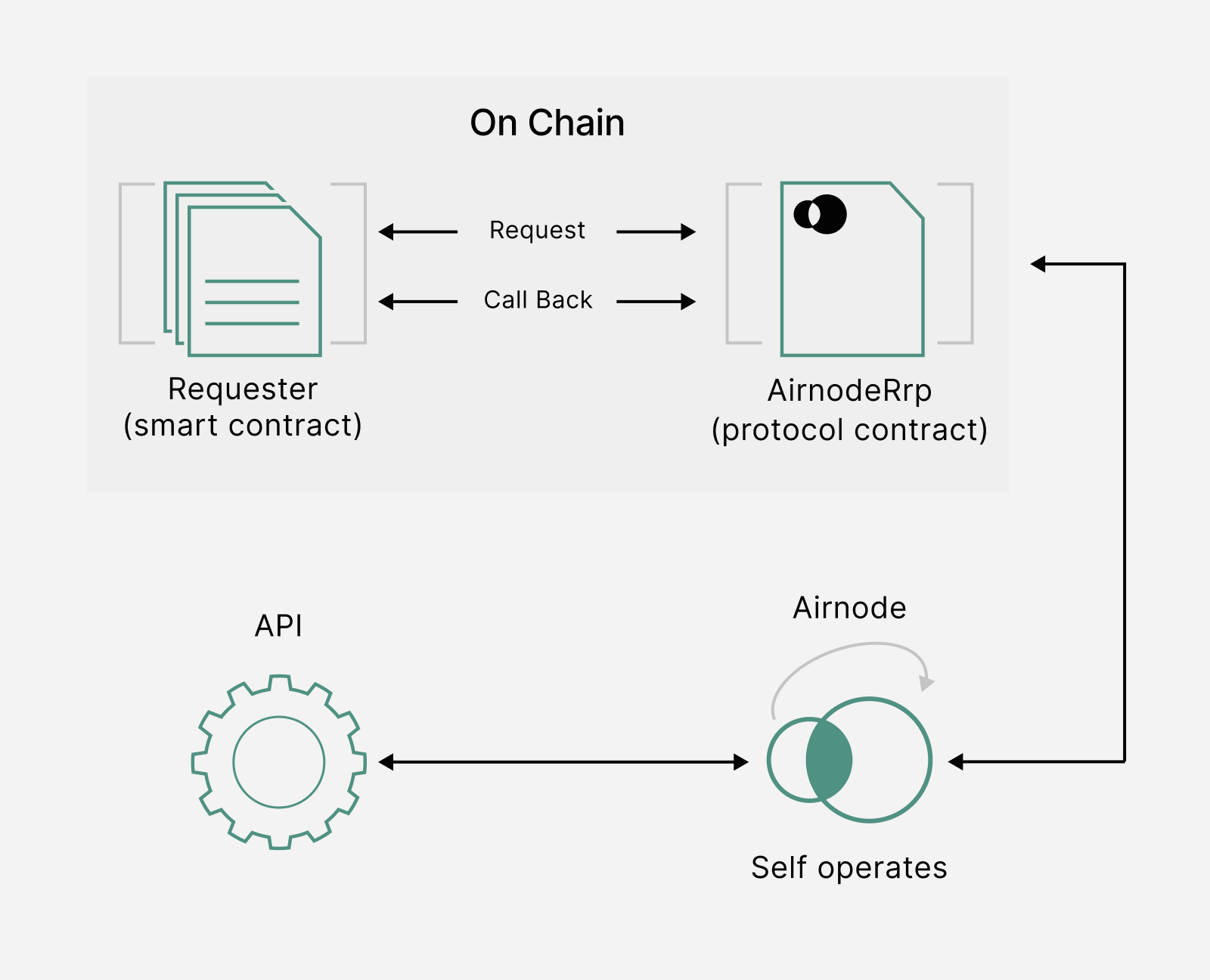

An on-chain smart contract makes a request in the RRP (Request Response Protocol) contract (AirnodeRrpV0.sol) that adds the request to the event logs. The Airnode then accesses the event logs, fetches the API data and performs a callback to the requester with the requested data.

Requesting off-chain data by calling an Airnode

Requesting off-chain data essentially involves triggering an Airnode and getting its response through your smart contract. The smart contract in this case would be the requester contract which will make a request to the desired off-chain Airnode and then capture its response.

The requester calling an Airnode primarily focuses on two tasks:

- Make the request

- Accept and decode the response

Here is an example of a basic requester contract to request data from an Airnode:

// SPDX-License-Identifier: MIT

pragma solidity 0.8.9;

import "@api3/airnode-protocol/contracts/rrp/requesters/RrpRequesterV0.sol";

import "@openzeppelin/contracts@4.9.5/access/Ownable.sol";

// A Requester that will return the requested data by calling the specified Airnode.

contract Requester is RrpRequesterV0, Ownable {

mapping(bytes32 => bool) public incomingFulfillments;

mapping(bytes32 => int256) public fulfilledData;

// Make sure you specify the right _rrpAddress for your chain while deploying the contract.

constructor(address _rrpAddress) RrpRequesterV0(_rrpAddress) {}

// To receive funds from the sponsor wallet and send them to the owner.

receive() external payable {

payable(owner()).transfer(address(this).balance);

}

// The main makeRequest function that will trigger the Airnode request.

function makeRequest(

address airnode,

bytes32 endpointId,

address sponsor,

address sponsorWallet,

bytes calldata parameters

) external {

bytes32 requestId = airnodeRrp.makeFullRequest(

airnode, // airnode address

endpointId, // endpointId

sponsor, // sponsor's address

sponsorWallet, // sponsorWallet

address(this), // fulfillAddress

this.fulfill.selector, // fulfillFunctionId

parameters // encoded API parameters

);

incomingFulfillments[requestId] = true;

}

function fulfill(bytes32 requestId, bytes calldata data)

external

onlyAirnodeRrp

{

require(incomingFulfillments[requestId], "No such request made");

delete incomingFulfillments[requestId];

int256 decodedData = abi.decode(data, (int256));

fulfilledData[requestId] = decodedData;

}

// To withdraw funds from the sponsor wallet to the contract.

function withdraw(address airnode, address sponsorWallet) external onlyOwner {

airnodeRrp.requestWithdrawal(

airnode,

sponsorWallet

);

}

}

The _rrpAddress is the main airnodeRrpAddress. The RRP Contracts have already been deployed on-chain. You can also try deploying it on Remix

| Contract | Addresses |

|---|---|

| AirnodeRrpV0 | 0xa0AD79D995DdeeB18a14eAef56A549A04e3Aa1Bd |

Request parameters

The makeRequest() function expects the following parameters to make a valid request.

airnode: Specifies the Airnode Address.endpointId: Specifies which endpoint to be used.sponsorandsponsorWallet: Specifies which wallet will be used to fulfill the request.parameters: Specifies the API and Reserved Parameters (see Airnode ABI specifications for how these are encoded). Parameters can be encoded off-chain using@airnode-abilibrary.

Response parameters

The callback to the Requester contains two parameters:

requestId: First acquired when making the request and passed here as a reference to identify the request for which the response is intended.data: In case of a successful response, this is the requested data which has been encoded and contains a timestamp in addition to other response data. Decode it using thedecode()function from theabiobject.

Sponsors should not fund a sponsorWallet with more then they can trust the Airnode with, as the Airnode controls the private key to the sponsorWallet. The deployer of such Airnode undertakes no custody obligations, and the risk of loss or misuse of any excess funds sent to the sponsorWallet remains with the sponsor.

Using dAPIs - API3 Datafeeds

dAPIs are continuously updated streams of off-chain data, such as the latest cryptocurrency, stock and commodity prices. They can power various decentralized applications such as DeFi lending, synthetic assets, stablecoins, derivatives, NFTs and more.

The data feeds are continuously updated by first-party oracles using signed data. dApp owners can read the on-chain value of any dAPI in real-time.

Due to being composed of first-party data feeds, dAPIs offer security, transparency, cost-efficiency and scalability in a turn-key package.

Apart from relying on deviation threshold and heartbeat configuration updates, unlike traditional data feeds, OEV Network enables dApps using dAPIs to auction off the right to update the data feeds to searcher bots. Searcher bots can bid for price updates through the OEV Network to update the data feeds. All the OEV proceeds go back to the dApp.

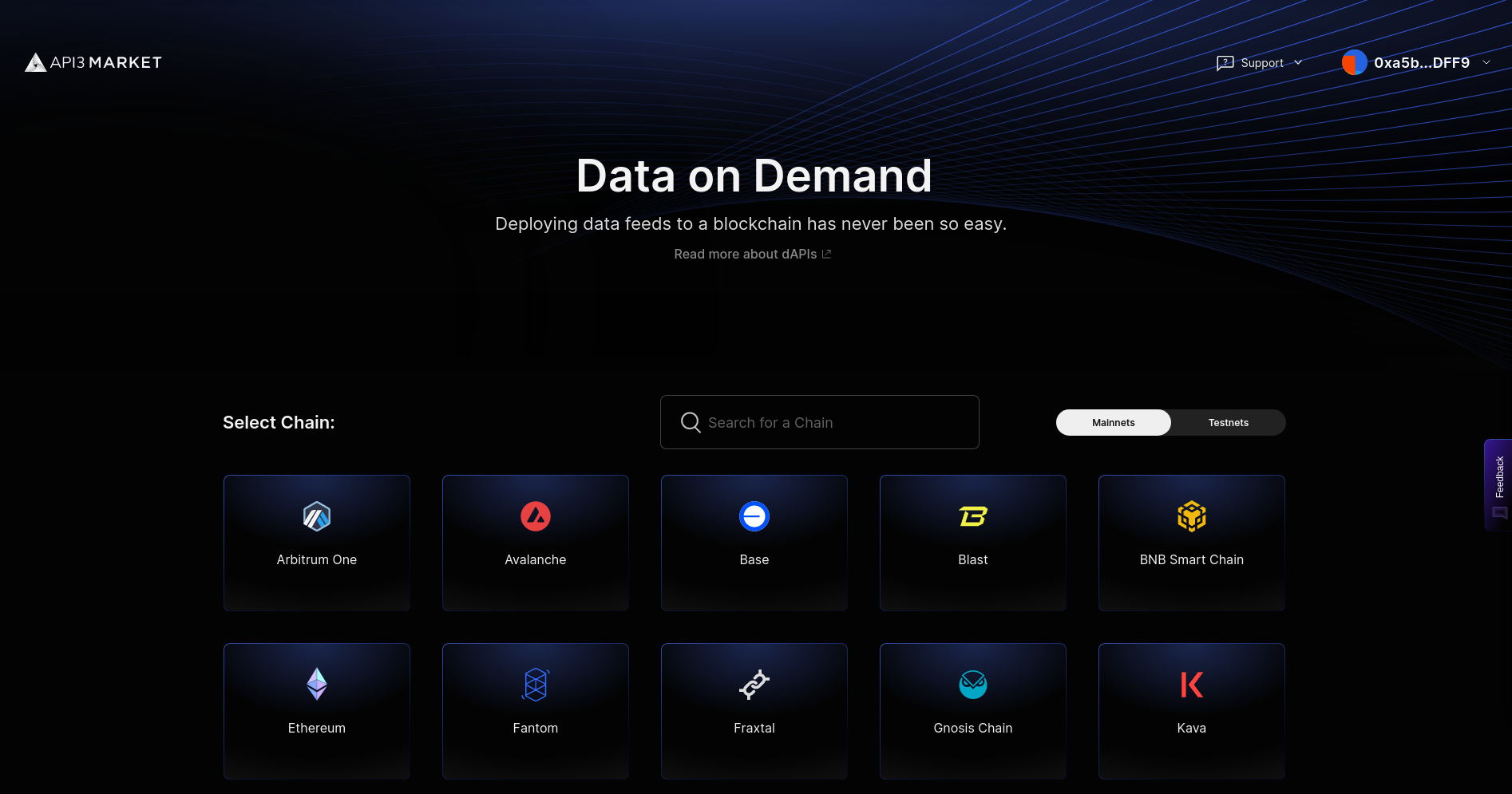

The API3 Market enables users to connect to a dAPI and access the associated data feed services.

To learn more about how dAPIs work, click here

Subscribing to dAPIs

The API3 Market lets users access dAPIs on both Kava Mainnet and Testnet.

Exploring, selecting and configuring your dAPI

The API3 Market provides a list of all the dAPIs available across multiple chains including testnets. You can filter the list by mainnet or testnet chains. After selecting the chain, you can now search for a specific dAPI by name. Once selected, you will land on the details page (eg ETH/USD on Kava Testnet) where you can find more information about the dAPI.

The current supported configurations for dAPIs are:

| Deviation | Heartbeat |

|---|---|

| 0.25% | 24 hours |

| 0.5% | 24 hours |

| 1% | 24 hours |

| 5% | 24 hours |

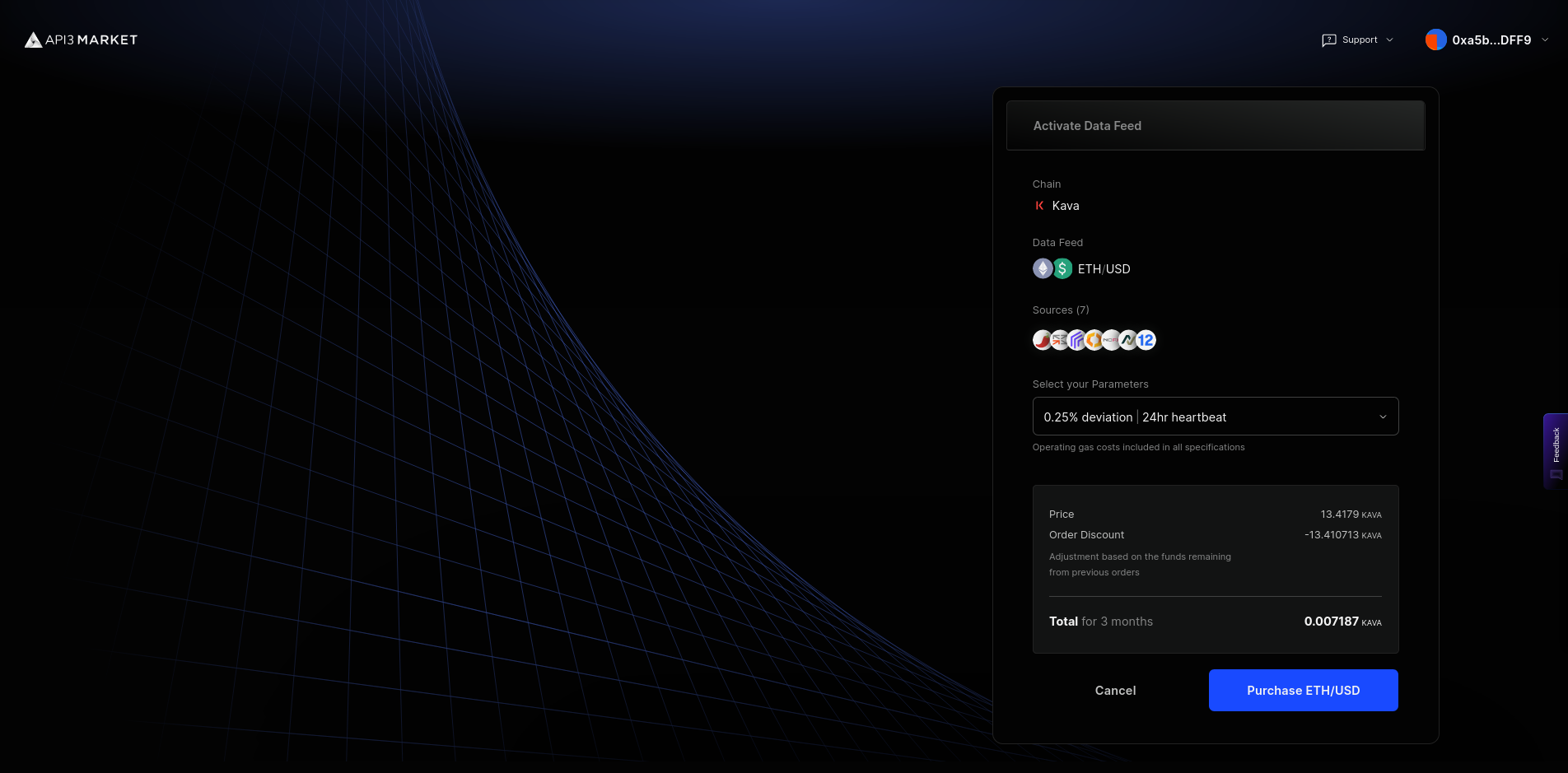

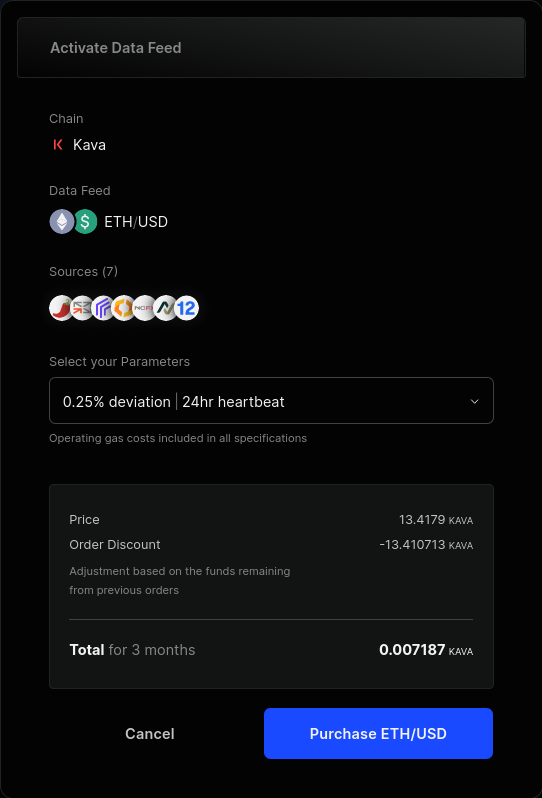

Activating your dAPI

Note

If a dAPI is already activated, make sure to check the expiration date and update parameters. You can update the parameters and extend the subscription by purchasing a new configuration.

After selecting the dAPI and the configuration, you will be presented with an option to purchase the dAPI and activate it. Make sure to check the time and amount of the subscription. If everything looks good, click on Purchase.

You can then connect your wallet and confirm the transaction. Once it's confirmed, you will be able to see the updated configuration for the dAPI.

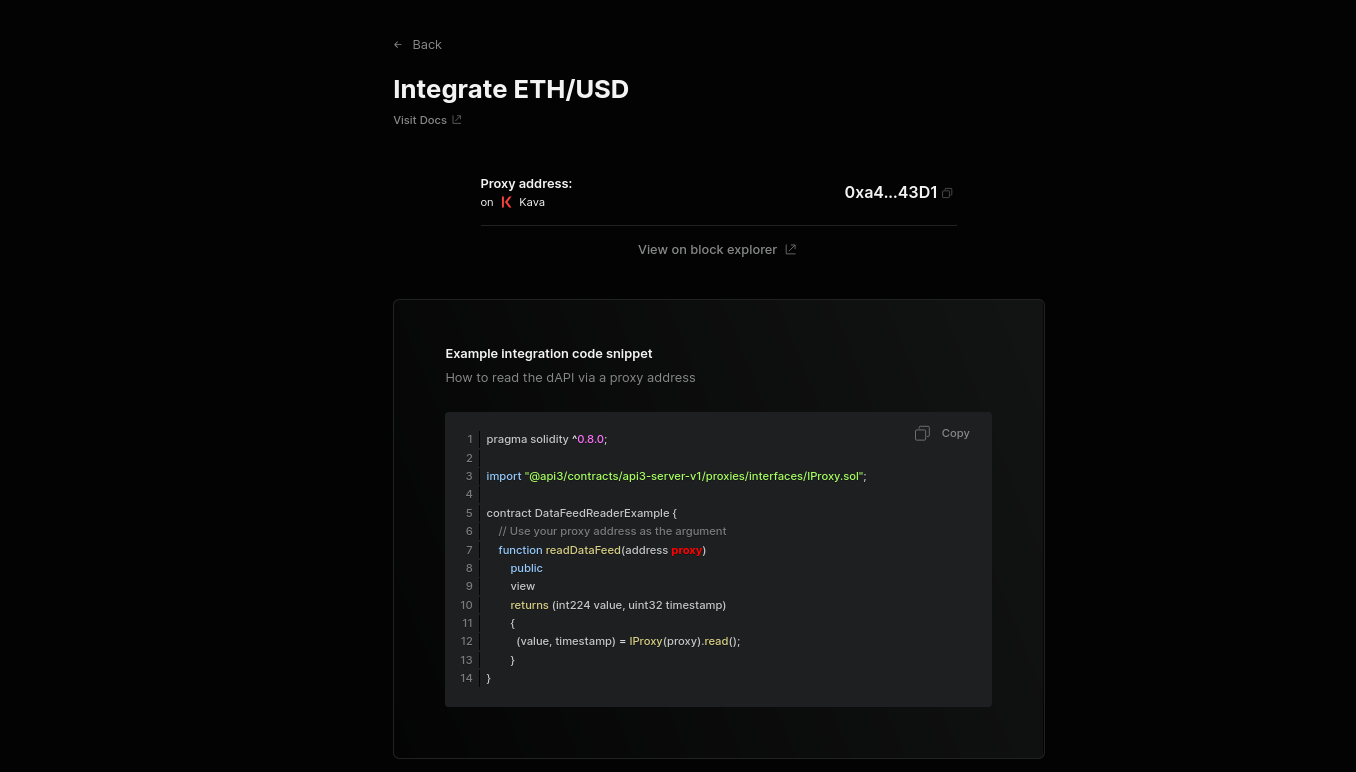

Getting the proxy address

Once you are done configuring and activating the dAPI, you can now integrate it. To do so, click on the Integrate button on the dAPI details page.

You can now see the deployed proxy contract address. You can now use this to read from the configured dAPI.

Reading from a dAPI

Here's an example of a basic contract that reads from a dAPI.

// SPDX-License-Identifier: MIT

pragma solidity 0.8.17;

import "@openzeppelin/contracts@4.9.5/access/Ownable.sol";

import "@api3/contracts/api3-server-v1/proxies/interfaces/IProxy.sol";

contract DataFeedReaderExample is Ownable {

// The proxy contract address obtained from the API3 Market UI.

address public proxyAddress;

// Updating the proxy contract address is a security-critical

// action. In this example, only the owner is allowed to do so.

function setProxyAddress(address _proxyAddress) public onlyOwner {

proxyAddress = _proxyAddress;

}

function readDataFeed()

external

view

returns (int224 value, uint256 timestamp)

{

// Use the IProxy interface to read a dAPI via its

// proxy contract .

(value, timestamp) = IProxy(proxyAddress).read();

// If you have any assumptions about `value` and `timestamp`,

// make sure to validate them after reading from the proxy.

}

}

setProxyAddress()is used to set the address of the dAPI Proxy Contract.readDataFeed()is a view function that returns the latest price of the set dAPI.

You can read more about dAPIs here.

Try deploying it on Remix!

Additional Resources

Here are some additional developer resources